A new era in private equity solutions

In the evolving landscape of private equity, continuation funds—also known as GP-led secondary transactions—are experiencing unprecedented growth. According to recent data, the number of these funds grew by 48%, reaching 73, with Preqin noting 25 additional vehicles already in 2024[1]. This surge reflects a fundamental shift in how general partners (GPs) manage high-potential assets, allowing them to extend their holding period beyond a traditional fund’s lifecycle.

By moving selected assets into a continuation fund, GPs can continue executing strategic initiatives for key assets, providing a flexible solution to market demands and investor preferences alike.

Nick McHardy, our Head of Funds at Belasko, and Sam Kay, a London-based private equity funds partner at the international law firm Dechert, share their views on the growing interest in continuation funds and adoption of these fund structures globally.

Why continuation funds are the preferred choice for modern GPs and LPs

Unlocking extended value creation

A primary driver for the popularity of continuation funds is the extended runway they provide for asset management and growth. Traditional private equity structures, often capped at a 10-year lifespan, can constrain GPs from fully capitalising on the potential of high-performing assets.

Continuation funds empower GPs to continue their strategic initiatives, ultimately enhancing value for investors. In the first half of 2024, GP-led transactions accounted for $31 billion, making up 43% of the total secondary market volume[2]. This reflects a 94% increase compared to the same period in 2023, driven by strong demand for continuation funds and the adoption of GP-led structures by sponsors seeking liquidity for LPs and extended holding periods for valuable assets[3].

Liquidity with flexibility

Continuation funds introduce a new level of liquidity and flexibility for limited partners (LPs). LPs can choose to cash out or reinvest in the continuation fund, accommodating their unique capital requirements. In Coller Capital’s 40th Global Private Capital Barometer, the demand for continuation funds remains strong, with about half of surveyed LPs planning to access the secondaries market, including continuation fund structures, within the next two years[4].

Sam Kay comments that: “We are now seeing dedicated funds being raised to invest specifically into continuation funds and GP-led secondaries, which indicates the attractiveness of these opportunities for institutional investors. In general, LPs are also increasingly sophisticated and are able to deal with the complexity of a continuation fund transaction”.

Strengthening GP-LP alignment

Continuation funds also foster a strong alignment of interests between GPs and LPs, ensuring GPs can retain control over key assets and adhere to the original fund objectives. This continuity can reassure both existing and new investors seeking stability and alignment in asset management strategies. As Sam Kay notes “There are a number of tools for a GP to build alignment with its investor-base. Over a number of years, we have witnessed the increase in co-investment activity and now we are seeing continuation funds being increasingly used. With continuation funds, there is a real sense of GPs and LPs working together to create that ‘win-win’ situation”.

Adapting to market dynamics with continuation funds

As private equity markets mature, investors are prioritising flexibility and optimised returns over longer periods. The traditional private equity model’s rigid timelines often don’t cater to the evolving demands of sophisticated investors. Continuation funds, by offering dynamic investment options, present a modern alternative that accommodates changing market conditions and investor requirements.

In Dechert’s 2025 Global Private Equity Outlook[5], 65% of respondent private equity firms noted that the increase in GP-led secondaries dealmaking was being driven by the demand for flexible holding periods for portfolio companies. The increased transaction volume in this sector reflects its growing role in private equity, as GPs and LPs seek solutions that extend value beyond the limitations of conventional fund structures.

Global adoption of continuation funds: trends and insights

Regional hotspots for continuation funds

The adoption of continuation funds has varied across regions and North America remains a dominant player with over 60% of global GP-led secondary market activity originated in the US[6]. This reflects a continued strong appetite for these deals in the region, especially multi-asset continuation fund transactions. With its mature private equity market and sophisticated investor base, the U.S. has been quick to recognise the benefits of continuation funds.

In Europe, countries like the UK and Germany continue to show significant momentum as investors embrace continuation funds for enhanced asset management and liquidity solutions. Meanwhile, in Asia, regions such as China, Japan, and India are beginning to explore these vehicles as private equity activity intensifies, driving a need for flexible investment options.

“The responses in our 2025 Global Private Equity Outlook back up these trends” says Dechert’s Sam Kay. “It is encouraging for, globally, almost a fifth of private equity firms (17%) are expecting to increase dealmaking through GP-led secondaries over the next two years but there are regional differences: in North America, the figure rises to 22% whereas in EMEA it is 14% and Asia-Pacific it is 10%”.

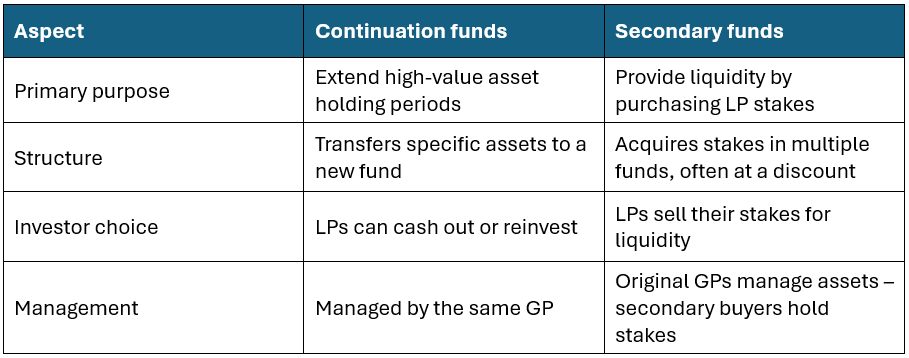

Comparing continuation funds and secondary funds

Continuation funds: meeting evolving investment needs

Continuation funds mark a transformative shift in the private equity landscape. Their rise addresses a critical need for extended value creation, tailored liquidity options, and alignment with investor interests. As market dynamics continue to evolve, the strategic advantages of continuation funds are anticipated to fuel their growth, offering investors and fund managers flexible solutions to adapt to a complex investment landscape.

How Belasko can support your fund continuation strategy

As a next-generation fund administration partner, Belasko provides a tech-driven approach focused on delivering customised client solutions. Our full scope, tailored fund administration services are designed to drive performance throughout the fund lifecycle – from establishment and capital deployment to realisation and wind up, we’re the experts when it comes to streamlining your operations.

Our experienced team of 120 experts, strategically located across the United Kingdom, Luxembourg, Jersey, and Guernsey, ensures precise, professional service across multiple asset classes. With over $12 billion in assets under administration (AUA), Belasko is well-equipped to offer personalised, innovative support for your continuation fund needs.

Get in touch with Nick McHardy ([email protected]) to discuss further.

About Dechert

Dechert is a global law firm that advises asset managers, financial institutions and corporations on issues critical to managing their business and their capital – from high-stakes litigation to complex transactions and regulatory matters. Its 1,000+ lawyers across 19 offices globally focus on the financial services, private equity, private credit, real estate, life sciences and technology sectors. Dechert’s global Secondaries and Sponsor-led Liquidity Solutions team has been involved in secondaries transactions for over two decades, advising sponsors, buyers and sellers on all types of GP and LP-led transactions and liquidity solutions, ranging from ordinary course sales of LP interests, to the most complex single and multi-asset continuation funds involving significant M&A transactions, NAV facilities, preferred equity funding and structured solutions. Find out more at www.dechert.com.

[1] Preqin, “Continuation Fund Vehicles 2023 Report”

[2] https://www.blackrock.com/institutions/en-us/insights/market-update-h2-2024

[3] https://www.jefferies.com/insights/the-big-picture/mid-year-review-a-record-breaking-1h-of-2024-for-the-secondary-market/

[4] https://www.collercapital.com/40th-barometer-allocations-distributions/

[5] https://www.dechert.com/knowledge/publication/global-private-equity-outlook.html

[6] https://www.secondariesinvestor.com/gps-look-to-multi-asset-continuation-funds-for-dpi-campbell-lutyens/