Operating models are currently being reviewed by a number of private capital fund managers and GPs in the pursuit to enhanced performance.

Once your objectives have been established (see previous article), there are two primary routes that may be taken.

- Scope status quo: keeping the scope of work outsourced the same.

- Scope change: change the scope by increasing the undertaking in-house or increasing the scope of outsourcing.

In this article, we explore the considerations of changing the scope of outsourcing.

Reviewing the options

In-source activities currently performed by a third-party

This involves identifying and bringing activities that are currently managed by external service providers back into the organisation.

Outsourcing activities currently performed in-house

Increasing the level of outsourcing has historically been used an option by fund managers and GPs to enhance performance by improving operational efficiency, managing risk and reducing cost.

Considerations when changing the scope of services outsourced

- Regulatory permissions – are regulatory permissions required to undertake the activity?

- Expertise and resourcing – what level of specialist expertise and/or resourcing is required to undertake the activity?

- Opportunity cost – is there a benefit of freeing up specific resource and/or an opportunity cost of allocating additional activities?

- Systems and data strategy – what’s the strategy around in-house system capability and the maintenance of data as an asset?

- Risk management and control – will a change in operating model require an investment in procedural environment?

- Relationship with your service provider(s) – is it likely that your relationship will change as a result of an adjustment to scope of services? Could this change provide other benefits or represent any risks?

- Contractual position with service provider(s) – if services are being terminated, what is the notice period (typically 3-6 months)?

- Time for service provider to onboard the additional services – for additional services, what’s the timeframe to onboard and embed additional services? Is there a mechanism in place to ensure additional services are embedded successfully?

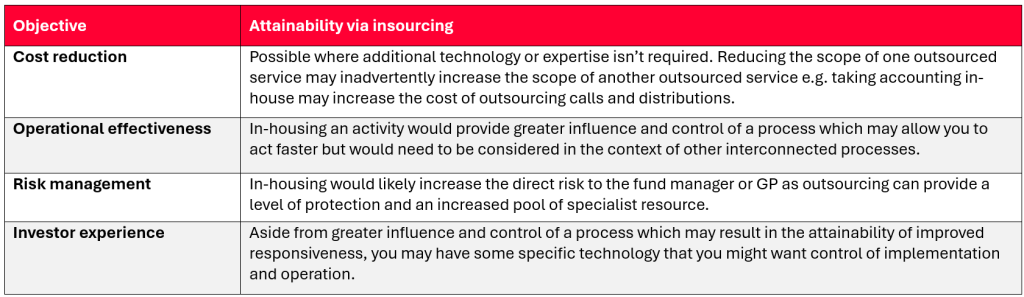

Fund managers have several strategic options to consider when changing their operating models. Insourcing and outsourcing decisions should be based on a thorough assessment of capabilities, costs, and strategic alignment.

As a next generation fund administrator, Belasko has developed a tailored service offering to support you in achieving your target operating model.

If you’d like to discuss your outsourced operating model in more detail, please get in touch with Nick McHardy, our Group Head of Funds at [email protected].

Next time, we explore how your objectives may be met by keeping the scope of services with your outsourced provider the same.