As we hit the 2024 halfway point, challenging fundraising conditions continue to persist (noting a contraction of 22% in global private capital fundraising in 2023[1]), as well as a high degree of fundraising concentration to the biggest managers and general deal inactivity.

Here we provide a pulse check on the key themes within the private capital funds industry as we all collectively plot a course forward for our respective businesses and specialisms. The key industry themes of note are around liquidity, ESG, operational performance and post-COVID considerations.

Liquidity

80%[2] of the capital raised by UK based fund managers and GPs in 2023 were housed within 10% of the funds, further to this, over 60%[3] of the funds that were raised were less than £100m.

The industry has responded to the liquidity gap through innovative liquidity solutions seeking to address GP and LP-led market demand for liquidity. 46% of the $112 bn[4] in global secondary volume in 2023 was fund manager or GP-led.

Improvement in secondary pricing

Following a significant rise in valuations within public markets during 2023 and macro environment stabilisation, there has been an improvement in pricing.

Across all strategies, pricing for LP positions were estimated at 85% of NAV in 2023 compared with 81% in 2022, but still trailing behind the 92% seen in 2021.

Rise of continuation funds

Continuation funds have emerged as a prominent trend in the private markets landscape, particularly within the private equity strategies.

These funds allow fund managers and GPs to extend the holding period of their most promising assets beyond the typical lifecycle of a fund by transferring these assets into a new vehicle, the continuation fund.

They provide an effective solution for fund managers and GPs to navigate market dynamics by offering liquidity to investors and extending the period of value creation by a manager with deep knowledge of the assets with a view to optimising overall returns.

Democratisation and tokenisation

Democratisation (also referred to as retailisation) extends the offering of private capital investment strategies into less institutional routes and has been the subject of exploration for some time. There are number of barriers which appear to still permeate the industry from a regulatory and infrastructure perspective, and much is still required to educate a wider investor base.

Political perception connected to private capital investment is also relevant as there needs to be effective political will and the resulting government policy to support.

These barriers appear to be starting to reduce; for example, the EU introduced a new ELTIF 2.0 legislation which became effective in January 2024 and is a more flexible and inclusive framework supporting a less institutional investor.

Tokenisation is often discussed in the same breath through providing fractional ownership with the use of blockchain technology that could support smaller investment sizes.

“The GFSC (Guernsey Financial Services Commission) [Commission] supports innovation and recognises the role tokenisation could play in improving efficiency within capital markets. The Commission is aware of growing interest, locally and internationally, in the application of this technology within the funds sector and this is an area of focus for fund regulators globally.” (14th May 2024 – Policy Statement – Approach to Fund Tokenisation)

Blockchain technology could also have wider implications for the industry by facilitating a more efficient transaction.

ESG

Environmental, Social, and Governance (ESG) continues to intensify within the private capital funds industry as a result of market expectations, regulatory and government intervention.

The emphasis on ESG stems from:

- Sustainability goals: Increasing pressure from stakeholders to adhere to sustainability and ethical investment practices.

- Regulatory requirements: Stricter regulations are pushing funds to integrate ESG criteria into their investment processes. Expected policymaking is anticipated to force rapid decarbonisation in the near future, driving funds to adopt more rigorous ESG standards.

- Investor engagement: There has been a massive increase in engagement from investors on ESG issues. The due diligence performed by investors is now extensive and this heightened scrutiny reflects a broader commitment to responsible investing.

- Performance metrics: Growing evidence suggests that ESG-compliant companies can outperform their non-compliant peers over the long term.

The EDCI (ESG Data Convergence Initiative) formed in 2021 and represents 425 + GPs and LPs from private equity, 4,300 portfolio companies and $28 trillion AUM.

They published data[5] which indicates that private equity ownership has a significant impact on ESG topics however performance for privately owned companies under private equity ownership on areas of sustainability is mixed relative to public companies, with some interesting themes that include:

- Decarbonisation – Private companies held for two of more years triple their use of renewable energy.

- Job growth – Private companies made 4% more net hires than public companies.

- Diversity – Private companies lagged public ones by 33 % with at least one woman on their board.

Operational performance

Market conditions are influencing a trend for private capital fund managers and GPs to perform an operating model review in pursuit of performance.

- Professionalising fundraising: Fund managers and GPs seek a route to professionalising[6] their approach to fundraising as a means to differentiate. This is likely to involve the provision of an enhanced data set to pre-empt questions and leverage technology in some way to support the consumption of that data set. Technology solutions also seek to support an enhanced investor/LP experience.

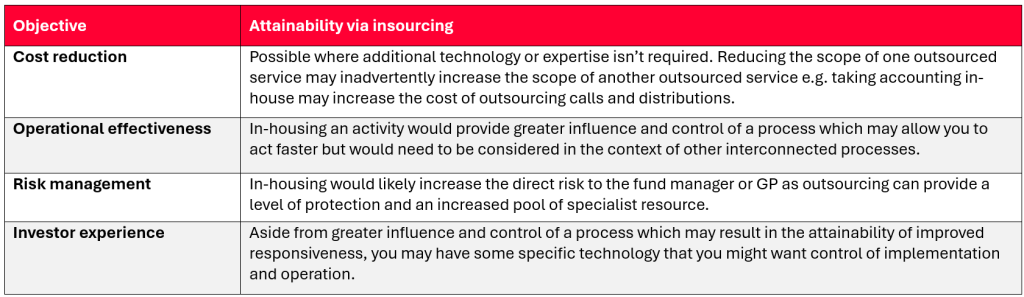

- Cost reduction: Adjustments to existing operating models and service provider change in the pursuit of cost reduction is a trend that will continue particularly if fund managers and GPs have a trajectory of reduced fund sizes and management fee pressure.

Post-COVID

COVID is gone but not forgotten as the significant impact of the pandemic still heavily impacts working practices.

There was clearly a high spike in growth capital invested during the COVID-19 period with global growth capital invested in 2021 at $910bn, compared with $399bn in 2019 and $470bn in 2023.

Emerging fund managers who launched in 2021 would expect to find a cooling of the reception received by prospect investors when fundraising this year and into 2025.

Positive outlook for the private capital landscape

Despite the observed fundraising challenges, the private markets remain vibrant and full of opportunity as the industry is adept at adapting and innovating to offer solutions and products to challenges and market demand.

As we go into the second half of the year, there’s a cautiously optimistic outlook with interest rates expected to start reducing supported by falling inflation. This being said, as 49% of the global population is subject to an election this year, including the USA, UK and EU there will be plenty of uncertainty to navigate.

At Belasko, our full scope, tailored fund administration solution is designed to drive performance throughout the fund lifecycle. With experts based across the UK, Channel Islands and Luxembourg, and leading technology that’s customised to you and your needs, we’re well positioned to provide you with responsive, accurate and consistent support.

Please get in touch with the Belasko team today to discover more.

[1] McKinsey Global Private Markets Review 2024 – March 28 2024

[2] BVCA Report on Investment Activity 2023 – 14 of 131 Funds equated to £47bn

[3] BVCA Report on Investment Activity 2023 – 83 of 131 Funds less than £100m

[4] Greenhill, Jefferies, J.P. Morgan Asset Management. “Global Secondary Market Review,” Jefferies, January 2024. Data are based on availability as of February 29, 2024.

[5] Boston Consulting Group – Private Equity Sustainability Report 2023

[6] Bain & Company Global Private Equity Report 2024